[Survey Results] How Law Firms Are Responding to COVID-19 – Finances

Editor’s Note: The COVID-19 pandemic has disrupted businesses in ways many of us could not have imagined at the beginning of 2020. MyCase wanted to understand the financial, operational, and individual changes law firms are making to maintain business continuity during this time, so we launched a nationwide survey from April 8th-10th and collected results from 819 legal professionals.

Law firms are experiencing unique business challenges presented by the COVID-19 crisis, the most prevalent being maintaining financial stability. Learn how firms are facing this and other challenges, and the steps they’re taking to keep their businesses solvent.

Economic Uncertainty

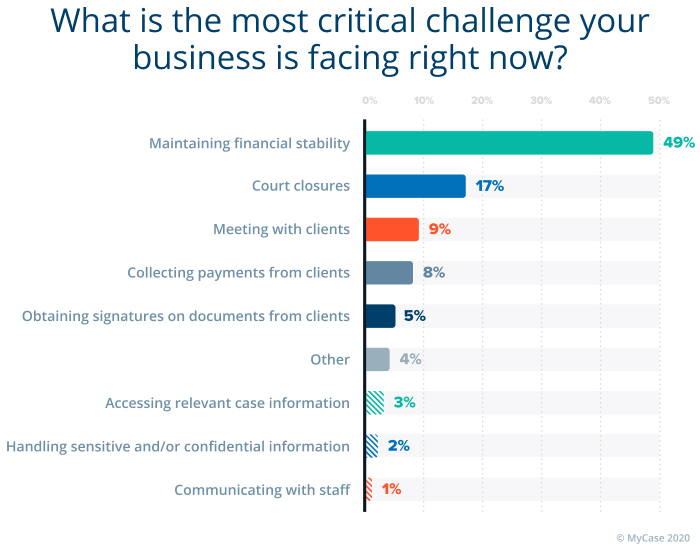

Of survey respondents — the majority of which have transitioned to working remotely — almost half of (49%) cited maintaining financial stability as their primary challenge. Many cited court closures as their firm’s primary challenge during this time (17%), and some cited difficulty meeting with clients (9%), difficulty collecting payment from clients (8%), and obtaining signatures on client documents (5%).

Maintaining Financial Stability

Attorneys are taking a number of approaches to combat financial loss in a predominantly virtual office setting — notably, cutting expenses, as reported by 32% of respondents. Others are adapting by reinvesting in marketing (16%) or expanding into practice areas that are more viable during this time to appeal to a broader variety of clients (7%). In efforts to collect payments from clients, 14% of firms surveyed have opted to offer their clients new payment methods. This speaks to the urgency of maintaining collections in a time when your physical office is no longer accessible to accept payments.

As firms take measures, such as cutting costs, to find stable footing economically, many have deemed their operational expenses non-negotiable. If your firm is struggling to maintain financial stability and would like to seek a government loan, take a look at this article on how to apply for Emergency SBA Relief Loans.

Thoughts & Advice from Fellow Law Firms

“Be as flexible as you can while meeting the needs of clients. It may cost a little bit of money now to implement new tools, but if it helps keep you in business, it will be worth it. Look into the options for small business loans as a safety net. Keep marketing, yet adjust to current restrictions, like video calls instead of in-person meetings, mediations when court is cancelled, etc.” -Heather Stuart, Godfrey Law & Associates, PLLC

“Increase streams of revenue, find ways to market services to needs coming out of the COVID crisis, use technology to keep costs low and efficiency of your workforce high.” -Joshua Kotter, AVantGarde Law, LLC

Related: [Blog Post] Remote Working: Lessons for Law Firm Leaders

“Research into state and local business loans or assistance. Consider taking cases outside of your normal area of practice and field, especially if you are knowledgeable in another area. Look at subscriptions and see if you can reduce cost anywhere and speak to vendors to see if they will reduce rates or fees. If you have employees, talk to them if there is financial concern, you’d be surprised what employees will do to help their boss if it means keeping a job they are happy at.” -Celeste Jameson, Law Office of Donna Jameson, LLC

Take a look at our additional survey results on remote work and productivity.