Trust Accounting: Ensure Compliance and Confidence for your Law Firm

“Attorney trust account rules” don’t have to be words that induce dread. While the horror stories are true (usually negligent cases), an efficient trust accounting system will keep your mind and legal license secure.

It starts with properly opening and managing trust funds for each client and ensuring that money is only taken out when earned. In this article, we’ll provide an overview and answers to the following:

- What is a trust account?

- What are attorney trust account rules?

- What are some attorney trust account best practices?

What is a Trust Account?

A lawyer trust account, also known as an Interest on Lawyer Trust Account (IOLTA), consists of money from the client (or awarded to the client) that is held as a trust.

Money in an IOLTA trust account can include:

- Unearned retainer or flat fees

- Disputed fees

- Settlement funds

- Court fees

- Advanced costs

In terms of attorney trust account rules, each legal jurisdiction is different; however, there are some standard guidelines. First, the money belongs to the client. The attorney cannot access it until it is earned through billable work. Second, these funds cannot commingle with any other accounts. For example, you cannot transfer unearned trust money from the trust account to an operating account—or cash out unearned charges.

Lastly, the law firm needs to uphold detailed and accurate records of all funds coming in and out of the IOLTA trust account—specifics vary by state. Ensure attorney trust accounting compliance with this resource, which provides specific state bar rules for each U.S. state.

Law Firm Trust Account Best Practices

Setting up detailed and well-managed attorney trust accounting is crucial for maintaining compliance. A trust accounting system also may be a requirement (in some jurisdictions). Below are best practices for efficiently and adequately handling client trust funds that abide by attorney trust account rules.

1. Create a Trust Account That Meets Compliance

The first step in trust accounting for lawyers is to create a trust account. This is typically performed in two ways.

Pooled Trust Account

This is the most common method for storing client trust funds. One account is created for housing all client trust money. However, your firm is responsible for keeping track and managing the exact amounts that belong to each client—as well as any deposits and withdrawals. This is performed via accounting ledgers and records management.

Separate Trust Account

There isn’t any significant need to open separate legal trust accounts unless it’s a substantial sum of money or specifically requested by the client.

Tips for Opening an IOLTA Trust Account

When you first open a trust account (or if you need to open additional legal trust accounts), conduct business with a bank that participates in an IOLTA program and a banker who knows how trust accounting for lawyers works. If they are confused about how to properly manage trust money, visit a different bank. For example, a banker who understands IOLTA will not charge bad check charges, maintenance fees, or other incidentals off the client’s trust money. Any such charges could result in sanctions.

Also, any interest earned on trust accounting does not belong to the attorney, firm, or client. These funds must be distributed to your local bar association. The associations generally use these interest funds for activities such as civil legal services.

2. Consider Limiting Your Trust Account Use

Minimizing the use of some attorney trust accounting is a way to manage cash flows without strict restrictions. Some state bars may have certain loopholes that can reduce the burden of law firm trust accounting. For example, attorneys may be able to forgo trust accounts when storing client funds if the money is under a specified limit.

However, exercise caution when considering this option by contacting your local state bar association. This will ensure that any method you pursue to reduce trust account usage is within compliance.

3. Separate Attorney and Client Funds

Properly dividing attorney and client trust funds will prevent accidental commingling. Separate these funds by storing all physical client trust checks and deposit slips in a different location than checks for the firm’s operating account.

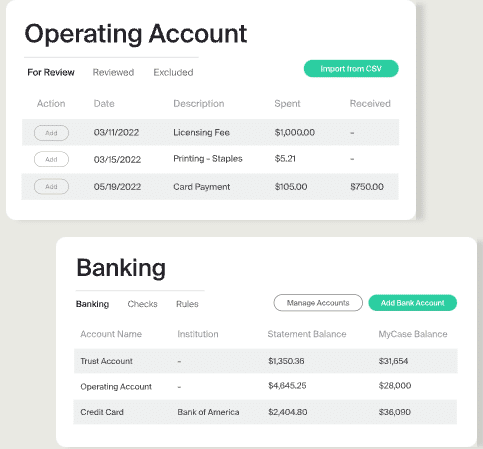

Also, consider legal payments software for easier separation of attorney and client funds. This online tool allows you to easily manage physical and electronic client payments between your firm’s trust account and operating account—ensuring compliance. In addition, software systems with built-in account management, such as MyCase Accounting, can help you properly bookkeep and ledger all law firm trust accounting under a single source—while meeting three-way reconciliation requirements.

For more on legal accounting software, read this article which highlights the elements of the best legal accounting systems.

4. Track Your Client Funds

Set up specific accounting ledgers for all client trust balances and activity. You should also request monthly trust accounting statements from your bank to ensure that all activity matches your firm’s ledgers. It is highly recommended that you electronically manage all trust fund accounting to avoid the mistakes of hand-written records. MyCase Accounting can help you efficiently and easily monitor client and admin ledgers under a single platform.

Trust Accounting Basics

For a user-friendly overview of electronic client trust accounting management, duties, and common mistakes, download our free Trust Accounting Basics guide.

Easily Manager Your Trust Accounts Today With MyCase Accounting

Consider adopting MyCase Accounting for easily and efficiently managing legal trust accounts. This cloud-based law firm accounting software is fully integrated into the MyCase platform to eliminate redundant data entry across multiple systems, provide seamless access to case files alongside your financial data, set up and monitor financial benchmarks, and more.

Try MyCase risk-free with a 10-day free trial. We offer affordable monthly and yearly subscriptions. Plus, there’s no commitment required; you can cancel anytime.