Choosing the Best Legal Accounting Software

By Sophia Lee

Accounting is critical to running a successful law firm. It helps you collect payments, stay compliant, and make the best financial decisions for your business. But without the right tools in place, the process can be overwhelming and time-consuming to manage. That’s where legal accounting software can help. We’ll explore the ins and outs of this tool in this overview.

What Are the Key Features of Law Firm Accounting Software?

The best law firm accounting software allows you to manage every aspect of your law firm’s finances effectively. Below are key features:

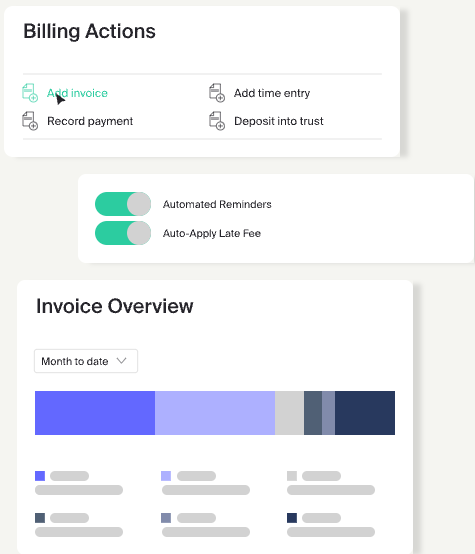

1. Legal Billing Software

Legal billing features help you streamline the entire billing, invoicing, and payment process. This is critical to the success of your business because it ensures payment for the work your firm performs for clients.

Using the right tool, you can collect more payments, increase your revenue, and take on more work to grow your firm. For example, MyCase helps thousands of firms with legal billing.

MyCase customers, on average, have seen positive cash flow/productivity results, including a:

- 46% increase in legal payment collection

- 37% increase in average caseloads

- 38% increase in revenue

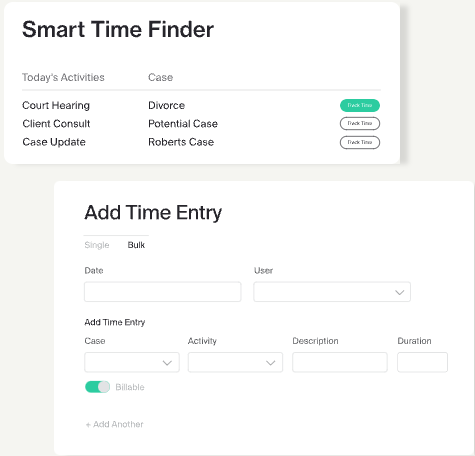

2. Time Tracking

Another key feature of comprehensive legal accounting software is time tracking. This benefit allows lawyers to plan, track, and report billable time as it occurs, so they don’t have to rely on memory when it’s time to invoice.

For instance, MyCase’s time-tracking law feature reduces the margin for error by automatically connecting time entries to each relevant case. These are then seamlessly consolidated into invoices, ensuring clients are always billed the right amount.

This law accounting software benefit also prompts your team to track time when logging a call, sending an email, saving a note, and uploading a document. Additionally, this function helps them remember to start auto-tracking that time.

For more information, read how you can boost time tracking efficiency with a billable hours chart.

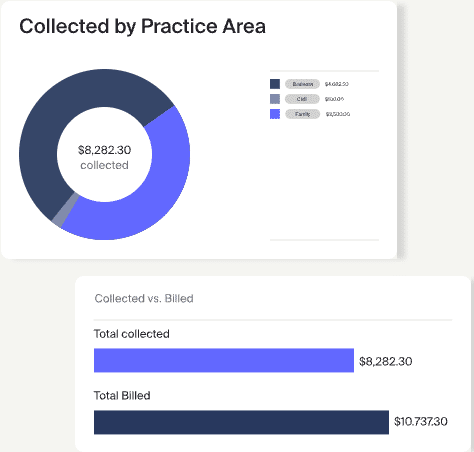

3. Financial Analytics

There’s also attorney accounting software that gives you insight into your financial picture. Some accounting software for lawyers provide financial dashboards that allow you to see data from bank balances, reconciliation information, outstanding invoices, budgets, and more at a glance.

For instance, with MyCase’s legal financial insights, you can gain valuable insight from its robust reporting options.

Below are a few types of reports you can generate using this feature:

- Fee allocation reports: Provide a clear and accurate picture of each employee’s financial contribution for every matter at your firm.

- Electronic payment reports: Provide a quick summary of all online payment activity at your firm, which is helpful for tax time.

- Aging invoice reports: Show a complete overview of outstanding balances owed to the firm.

- Time and expense reports: Show all billable and non-billable time, expenses, and line item invoice status for all cases and employees at your firm.

- Trust account reports: Track trust balances to reconcile trust retainer accounts and stay in compliance with state laws.

- Accounts receivable reports: Show your firm’s total receivables so you can understand the exact status of invoices and take prompt action toward collecting and reconciling accounts.

Below is an example of one of the many reports you can view with MyCase’s financial insight feature.

The Benefits of Accounting Software for Law Firms

There are many upsides to implementing accounting software for lawyers into your firm’s processes.

Provides financial insights

Regular financial reporting provides valuable insights into your business. The best reporting features can give you a holistic view of your firm, its growth, and its performance—allowing you to make strategic, data-driven decisions.

Let’s say you pull an aging invoices report for a complete overview of outstanding balances owed to the firm. You notice that the majority of unpaid invoices belong to the clients of one lawyer at this firm. With this information, you can reach out to that person to understand what’s blocking them from receiving payments.

For more insight, read this article on setting law firm financial benchmarks.

Automates key processes

The best law firm accounting software can automate many processes at your firm.

Benefits include:

- Time savings

- Cost savings

- Reduced stress for lawyers

- Increased profitability for the firm

For example, with some accounting software for law firms, you can set up automatic reminders for payments. This can help speed up the payment process without adding more work to your lawyers’ plates or sacrificing billable hours.

Ensures compliance

Every business needs to follow specific regulations when it comes to accounting.

For instance, you likely have a client trust account (CTA). These accounts come with specific trust account requirements—such as not withdrawing unearned funds or depositing the firm’s funds until the case’s conclusion. However, if your legal accounting process is disorganized, you may inadvertently break the rules.

That’s why it’s critical for your firm’s financial records to be as accurate as possible. Using the right attorney accounting software will help you organize, process, and track your money correctly so that your firm stays trust compliant and avoids penalties.

How to Choose the Best Law Firm Accounting Software for Your Law Firm

Not all law accounting software is the right fit for your firm. It’s essential to choose the right solution that fits the unique processes of your law firm.

1. Assess your needs

We recommend taking a two-pronged approach to assessing your law firm’s accounting needs. First, ask yourself what you need from the attorney accounting software today. What are your most pressing pain points? What tool will make an immediate, noticeable difference in your business? These are your must-haves.

Second, think about what you might need in the future. What type of features would help your law firm scale? These are your nice-to-haves.

When vetting potential law firm accounting software solutions, you want to make sure the one you choose checks all your must-haves and, if possible, has a handful of your nice-to-haves.

2. Pick a legal-specific solution

You can technically use general accounting software for your law firm. However, we recommend using a solution designed specifically for the legal industry.

These tools will have features customized to lawyers’ specific needs. For instance, MyCase’s invoicing feature integrates UTBMS codes and LEDES billing. This is a benefit that generic accounting software wouldn’t have.

3. Estimate your budget

Finally, you want to take your budget and firm size into consideration. Some solutions may be out of your desired price range, while others may not be built for smaller businesses—if you manage a more boutique firm. Try to look for law firm accounting software that meets both these needs. At MyCase, we offer solutions that are built for every budget and firm size.

Consider MyCase for Your Law Firm Accounting Software

Using attorney accounting software is guaranteed to make your life much easier. Consider MyCase Accounting. This cloud-based solution can save your lawyers time, improve your firm’s profitability, and keep your finances compliant. If you’re curious about MyCase’s law accounting software offerings, give us a try with a free trial.