Law Firm Billing 101: How to Invoice Efficiently and Get Paid Quickly

Administrative tasks like law firm billing and invoicing can be a huge time suck if not done efficiently. According to the MyCase 2021 Legal Industry Report (which surveyed over 2,000 legal professionals), 52% of respondents identified invoice creation as a top billing struggle. That’s why it’s so important to have streamlined processes in your law firm that:

- Reduce the repetitive tasks associated with tracking and entering billable time.

- Simplify the invoice creation process.

- Make it easy to send invoices to clients., and

- Standardize the steps required to accept, receive, and account for payments.

Creating an efficient invoicing workflow in your law firm may seem like a daunting task. Fortunately, legal invoicing software can turn the usual “run of the gauntlet” into an efficient, productive system. In this article, we unveil five key tips for building an invoicing operation that captures more billable hours, enhances your firm’s productivity, and accurately/clearly lists all billable work.

1. Make it Easy to Track Time

For lawyers who bill by the hour, time is money. That’s why it’s so important to make it easy to keep track of billable time, whether it happens in the office or in the courtroom.

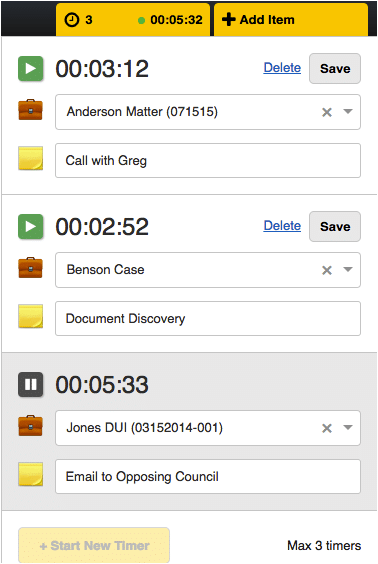

For starters, make sure that you are able to track billable time using software that incorporates multiple timers (such as MyCase). The best legal invoicing software also allows you to enter billable time anywhere, whether at your firm’s desktop or on a mobile device.

Another way to increase law firm billing efficiency is to simplify the steps needed to convert billable activities into billable time on an invoice. Billing software can accomplish this goal in any number of ways. For example, with the click of a button you can convert events or tasks into billable time. Another timesaver is the ability to take advantage of default billing activity descriptions when entering billable time. The easier it is for your attorneys to create a time entry, the more likely they are to do it.

2. Simplify the Legal Invoicing Creation Process

Before the advent of electronic billing, creating and sending out paper invoices used to be a time-consuming process. Fortunately, legal billing software has changed that by making it easier to generate legal invoices quickly and immediately send them to clients electronically.

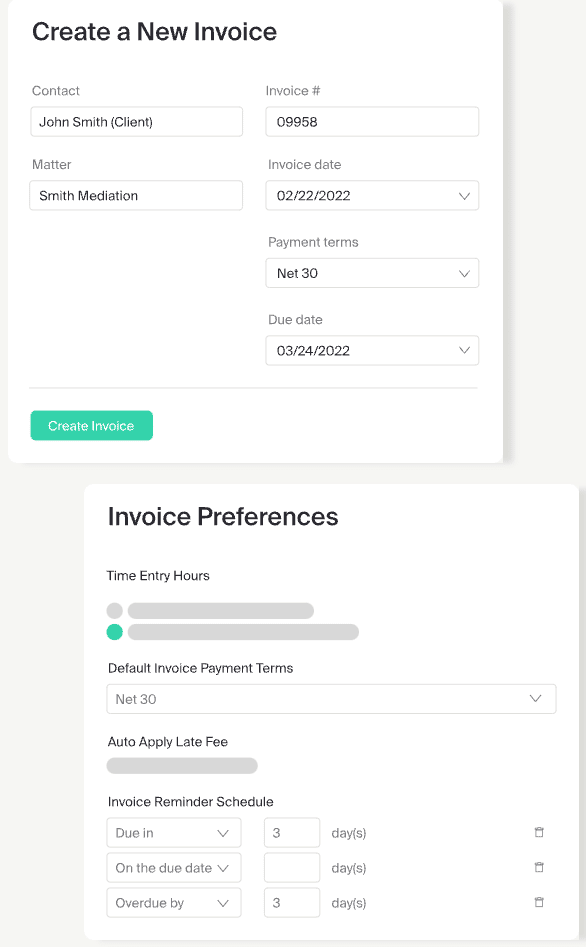

There are a host of ways to reduces legal billing inefficiencies, but one of the easiest is to limit the number of steps needed to create and send out invoices. One way that legal billing software accomplishes this goal is by automatically providing necessary billing information, such as LEDES billing codes. Additionally, the built-in ability to customize invoices allows you to easily determine what information appears on your firm’s invoices, such as which time or expense entry columns you would like to appear on an invoice. For example, with the click of a mouse, you’re easily able to remove all time entries during the invoice creation and generate an expense-only invoice.

3. Automate Legal Invoicing Reminders

Another way to improve your law firm’s legal billing process is to use software that allows you to set up automated invoice reminders. With this built-in tool, you can schedule reminders when you send out the very first invoice to a client. If the invoice isn’t paid, a follow up invoice will automatically be sent to the client, reminding the client that the billed amount is still outstanding.

This convenient tool will save your law firm time and money. The initial invoice needs to be sent just once; after that, the software follows up with your client.

Additional advantages of law firm invoice automation include:

- Reduced human error from the elimination of typed or hand-written invoices

- Auto population of attorney tracked time/digital notes into each invoice when it’s time to bill the client

- Greater cash flow and timely bills from electronic sending options

4. Allow Clients to Set Up Law Firm Billing Payment Plans

Another way to get paid quickly is to allow your law firm’s clients to set up payment plans for their legal bills. By doing this you provide your clients with increased flexibility—making it easier to pay large legal bills.

Start by using legal billing software to set up a payment plan using the built-in payment plan features. You can create the payment plan, establish the amounts due and due dates, and share with your clients. Then, clients can then instantly pay via eCheck, ACH, or or credit/debit card using built-in online payment tools You can then set up invoice reminders for the amounts due. That way, your client has all the information needed to make regular payments under the payment plan, and receive convenient reminders when payments are due.

Get paid for what you’re owed, faster.

Find out how McFarling Law Group increased their collectability from 60% to 85% with using MyCase.

5. Utilize Advanced Lawyer Billing and Revenue Reporting Features

Finally, ensure that your law firm’s billing process is as efficient and effective as possible by tracking and analyzing your firm’s financial and billing information. This is performed by running reports that provide you with an overview of your law firm’s billing, invoicing, and collection data. Depending on the software you use, you may have the following types of law firm reports available to you:

Aging invoice report: This report shows overdue balances grouped into 1-15, 16-30, 31-60, and 61+ days overdue.

Accounts receivable report: This report details your law firm’s receivables, which can be filtered to show a particular client or case. You can also choose various grouping options to better format the data for your law firm’s specific needs.

Case revenue report: Shows cases billed during a certain time period and allows comparison of monies earned on those cases during that same timeframe.

Fee allocation report: Displays amounts billed and collected by specific users at your firm during a certain time period.

User time and expenses report: Provides time and expense entries for a particular employee of your firm.

Case time and expenses report: Provides time and expense entries for a particular case/matter.

Trust account summary report: Shows all contacts with trust balances, including total credit, total debits, and “as-of” balance.

Trust account activity: Displays a chosen client’s trust account activity.

Non-trust retainer & credit account summary report: Provides an overview of all contacts with non-trust retainer & credit balances as of a specified date.

Non-trust retainer & credit account activity report: Shows a client’s non-trust retainer & credit account activity.

Case list report: Displays cases based on case status (open/closed) and practice area, and you can also group cases by practice area, firm user, client, and fee structure.

Statute of limitations report: Shows pending and expired statute of limitations deadlines for all firm cases, or those assigned to a single attorney.

Electronic payments report: Shows all payment activity made via eCheck and Credit Card within a specified time frame.

Credit card fees report: Offers a detailed view into which fees taken from the Operating account.

For more on implementing legal e-billing software, read this guide.

Get Started Today With MyCase Legal Invoicing Software

Try MyCase legal invoicing software risk-free with a 10-day free trial. We offer affordable monthly and yearly subscriptions. Plus, there’s no commitment required, and you can cancel anytime.